Personal Loans Canada Fundamentals Explained

Personal Loans Canada Fundamentals Explained

Blog Article

What Does Personal Loans Canada Do?

Table of Contents5 Simple Techniques For Personal Loans CanadaThe Main Principles Of Personal Loans Canada What Does Personal Loans Canada Do?The Only Guide to Personal Loans CanadaLittle Known Facts About Personal Loans Canada.

This indicates you have actually provided each and every single dollar a job to do. putting you back in the driver's seat of your financeswhere you belong. Doing a regular budget will provide you the self-confidence you need to manage your money efficiently. Good things pertain to those that wait.Saving up for the big points means you're not going right into financial obligation for them. And you aren't paying more over time because of all that passion. Depend on us, you'll delight in that family cruise ship or playground collection for the kids way a lot more knowing it's currently spent for (rather than paying on them until they're off to college).

Nothing beats comfort (without financial debt of course)! Debt is a charlatan. It reels you in only to hang on for dear life like a crusty old barnacle. You don't have to turn to personal finances and financial debt when things get tight. There's a much better method! You can be cost-free of debt and start making genuine grip with your cash.

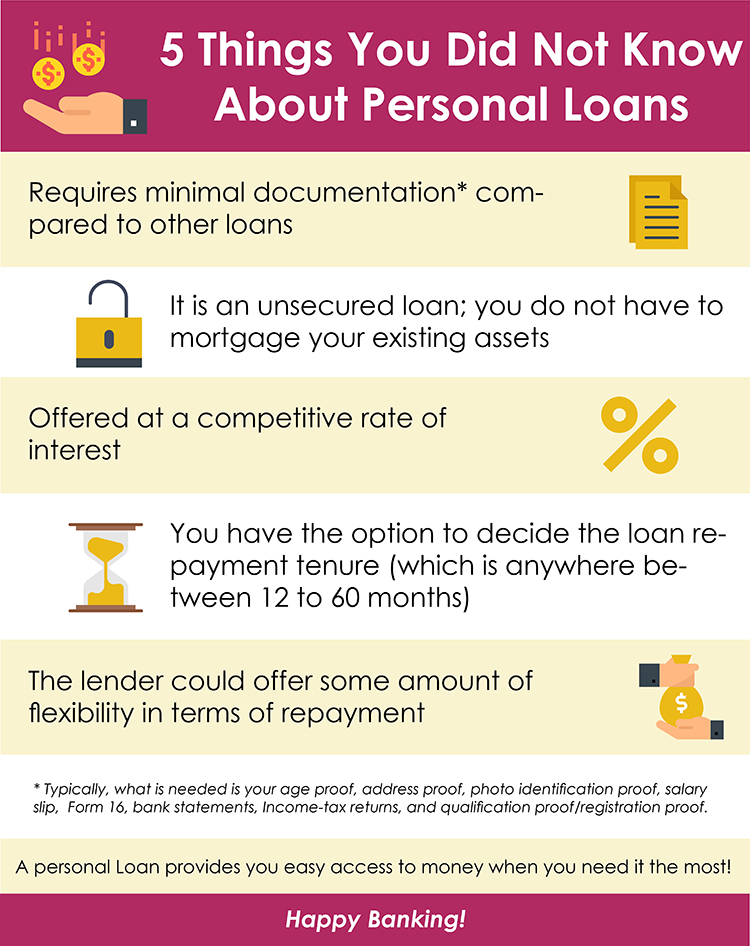

They can be secured (where you provide collateral) or unprotected. At Spring Financial, you can be approved to borrow money up to funding quantities of $35,000. A personal loan is not a line of credit score, as in, it is not rotating financing (Personal Loans Canada). When you're approved for a personal funding, your lending institution provides you the sum total simultaneously and then, typically, within a month, you start repayment.

The 20-Second Trick For Personal Loans Canada

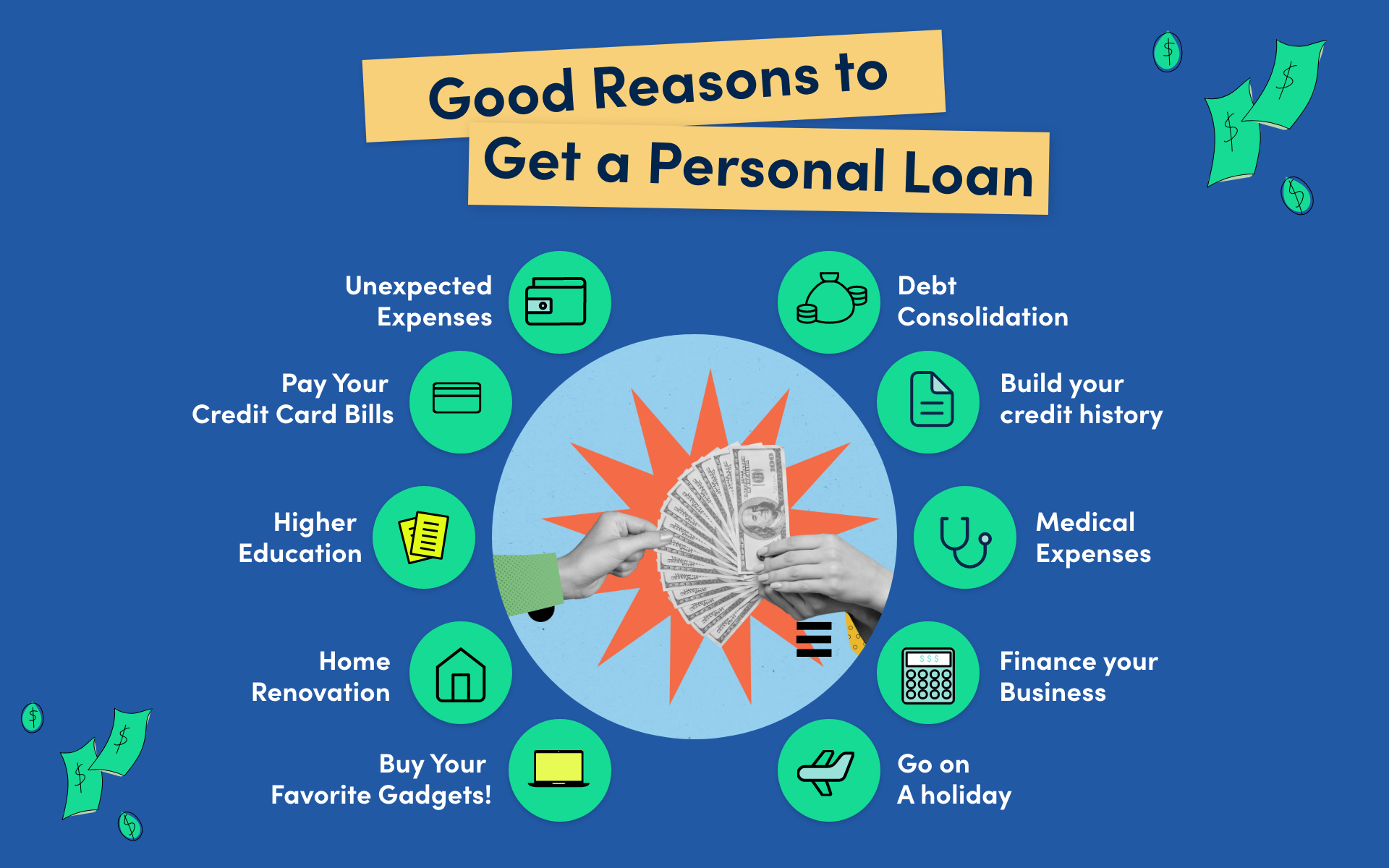

A typical factor is to consolidate and combine financial obligation and pay every one of them off simultaneously with an individual funding. Some banks put specifications on what you can utilize the funds for, yet numerous do not (they'll still ask on the application). home renovation fundings and renovation finances, car loans for relocating expenses, getaway financings, wedding event financings, medical finances, vehicle repair service loans, fundings for rental fee, small auto loan, funeral fundings, or various other costs payments in general.

At Springtime, you can use no matter! The demand for personal car loans is increasing among Canadians curious about running away the cycle of payday advance, combining their financial obligation, and restoring their credit history. If you're getting a personal funding, right here are some points you must bear in mind. Personal fundings have a set term, which indicates that you understand when the financial obligation has to be settled and just how much your payment is every month.

Not known Incorrect Statements About Personal Loans Canada

Furthermore, you could be able to reduce just how much total passion you pay, which means even more cash can be conserved. Individual lendings are effective devices for accumulating your credit report rating. Settlement background accounts pop over to these guys for 35% of your credit rating, so the longer you make routine payments on time the extra you will see your rating boost.

Personal loans supply a terrific opportunity for you to restore your credit score and settle financial debt, however if you don't spending plan properly, you can dig yourself right into an even much deeper hole. Missing among your regular monthly settlements can have an unfavorable impact on your credit report but missing out on several can be ravaging.

Be prepared to make every solitary payment in a timely manner. It's true that a personal loan can be utilized for anything and it's less complicated to get authorized than it ever before was in the past. However if you do not have an immediate need the additional cash money, it could not be the most effective option for you.

The look at this web-site dealt with monthly look at here now payment amount on an individual financing depends on exactly how much you're obtaining, the passion rate, and the fixed term. Personal Loans Canada. Your rate of interest will certainly rely on factors like your credit history and income. Most of the times, individual funding prices are a great deal less than bank card, yet often they can be greater

The Best Strategy To Use For Personal Loans Canada

Perks consist of fantastic passion rates, incredibly fast processing and funding times & the anonymity you may desire. Not every person suches as strolling into a bank to ask for cash, so if this is a difficult spot for you, or you just do not have time, looking at on the internet lending institutions like Spring is a great option.

That mostly relies on your ability to pay off the quantity & pros and cons exist for both. Settlement lengths for individual lendings normally drop within 9, 12, 24, 36, 48, or 60 months. In some cases longer settlement periods are a choice, though uncommon. Much shorter repayment times have extremely high month-to-month payments however after that it mores than rapidly and you do not shed even more money to interest.

The Definitive Guide for Personal Loans Canada

Your rate of interest can be tied to your payment duration too. You could obtain a lower rate of interest if you finance the finance over a much shorter period. A personal term car loan includes a set settlement timetable and a dealt with or floating rates of interest. With a floating rates of interest, the interest amount you pay will fluctuate month to month based on market changes.

Report this page